DIE FÜNF HAUPTGRÜNDE, UM IN KUNST ZU INVESTIEREN

NACHGEWIESENE WERTSTABILITÄT

Hochwertige Kunst hat nachweislich ihren Wert über die Zeit erhalten und gesteigert, selbst in volatilen Märkten.

PORTFOLIODIVERSIFIKATION

Kunst ist ein alternatives Anlagegut, das Ihr Portfolio über traditionelle Investitionen wie Aktien und Immobilien hinaus diversifiziert.

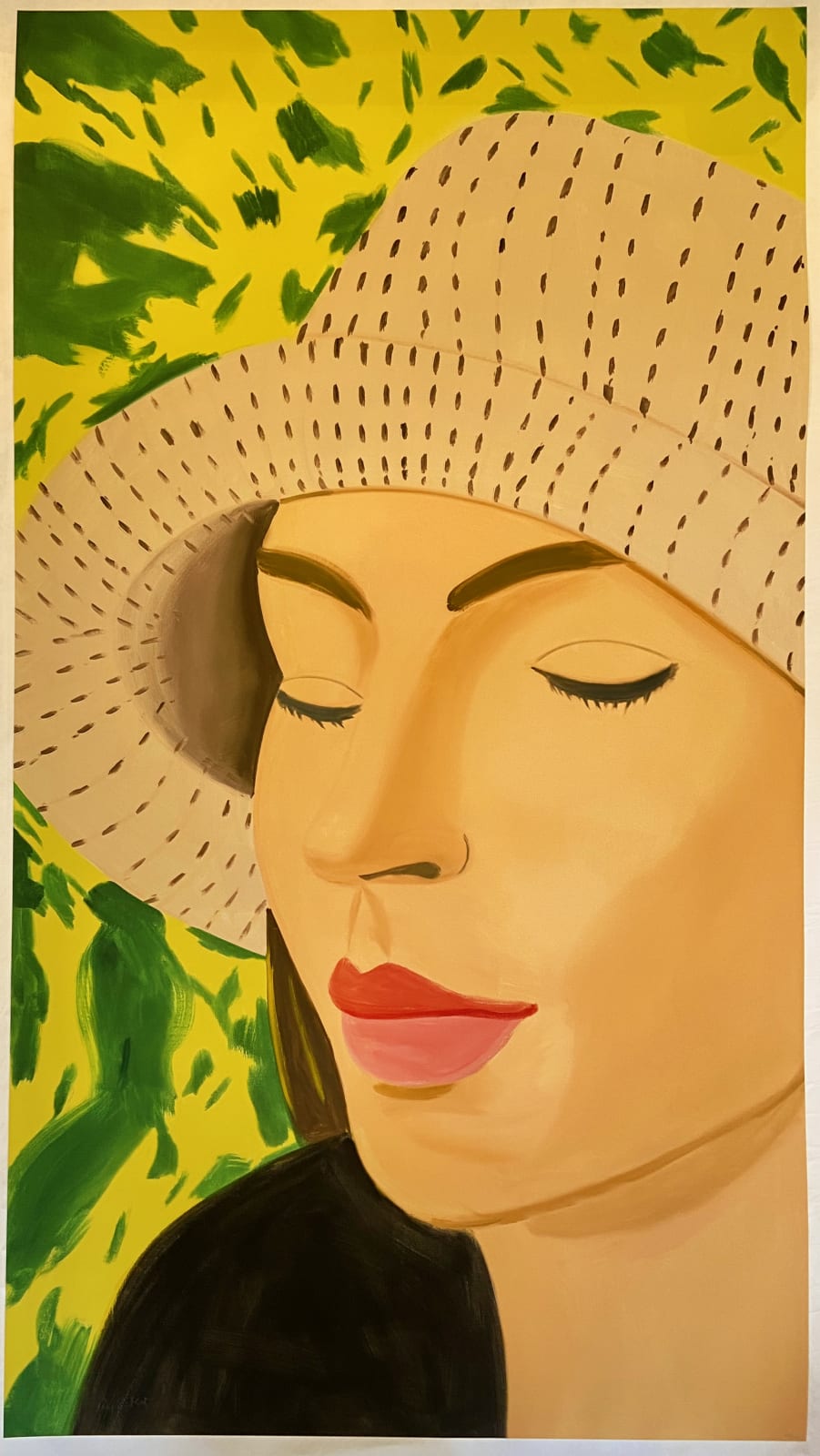

KULTUR‐ UND EMOTIONALE ANZIEHUNG

Über den finanziellen Gewinn hinaus bringt Kunst ästhetischen und kulturellen Wert, der Ihren Wohn‑ oder Arbeitsraum bereichert.

SCHUTZ VOR INFLATION

Kunst dient oft als Absicherung gegen Inflation und bewahrt Wohlstand, wenn Währungen schwanken.

GLOBALE ANERKENNUNG UND LIQUIDITÄT

Blue‑Chip‑Werke sind weltweit anerkannt und bieten größere Liquidität, wenn Sie entscheiden, zu verkaufen oder zu handeln.

Kontaktieren Sie uns für persönliche Beratung beim Erwerb von Kunst mit hohem Wert für Ihre Sammlung.

FÜNF FEHLER, DIE MAN BEI BLUE‑CHIP‑KUNSTINVESTMENTS VERMEIDEN SOLLTE

Auf professionelle Beratung verzichten

Den modernen Kunstmarkt zu navigieren kann komplex sein. Vermeiden Sie Entscheidungen ohne Rücksprache mit vertrauenswürdigen Experten, die Einsicht in die besten, wertvollen Kunstsammlungen bieten und sicherstellen, dass Sie in authentische Werke investieren.

Provenienz und Authentizität vernachlässigen

Das Versäumen, die Herkunft und Echtheit eines Kunstwerks zu prüfen, kann kostspielige Fehler mit sich bringen. Lassen Sie sich von Fachleuten dabei helfen, Mittel zur Bewertung der Provenienz zu nutzen und die Legitimität Ihrer Investition zu garantieren.

Den Wert vertrauensvoller Galerienbeziehungen unterschätzen

Vertrauenswürdige Beziehungen zu etablierten Galerien sind essenziell, um den Kunstmarkt sicher zu betreten. Diese Partnerschaften bieten maßgeschneiderte Beratung, abgestimmt auf Ihre Ziele, und sichern Zugang zu sorgfältig ausgewählten, hochwertigen Kunstwerken, die Ihrer Vision entsprechen. Mit ihrer Expertise bieten Galerien klare und zuverlässige Wege, informierte Investitionsentscheidungen zu treffen und Ihre Sammlung zu bereichern.

Langfristige Beziehungen ignorieren

Kunstsammlung ist eine Reise. Vermeiden Sie Kurzfristigkeit, indem Sie dauerhafte Partnerschaften mit Beratern aufbauen, die Ihren Geschmack und Ihre Ziele verstehen, Ihnen helfen, sich Trends anzupassen und Ihr Portfolio zu diversifizieren.

Die Bedeutung von Galerieberatung unterschätzen

Wenn Sie Ihre Sammlung nicht aktiv managen und regelmäßig aktualisieren, kann sich ihr langfristiges Potenzial verringern. Eine gut kuratierte Sammlung gedeiht durch fortlaufende Erneuerungen, die bleibenden Wertzuwachs und stärkere Wirkung - sowohl ästhetisch als auch finanziell - sichern.

Kontaktieren Sie uns und lassen Sie uns Sie auf Ihrer Reise zum Kunstsammler begleiten.